Vehicle insurance is more of an agreement between the owner of a vehicle and the insurance company hence involving a protection against losses or physical damages incurred due to accident or theft of the vehicle among other uncertain occurrences in Comparison of Vehicle Insurance

Most of the countries make this a requirement by law as well as essential in giving road safety and financial security. To drivers, the right insurance coverage leads to the effect of arousing peace and assurance of lack of unexpected costs.

The benchmark of these types of the vehicle insurance and insurance companies will help people choose the most appropriate insurance cover depending on their need, cost effective aspect of insurance and their driving ability so that they can enjoy the best and extreme value of their insurance cover.

Types of Comparison of Vehicle Insurance

There are several types of vehicle insurance, each offering different levels of protection to suit various needs:

1. Third-Party Insurance

This is the minimal auto insurance which is compulsory in most countries. It is a coverage skill that protects damages or injury of another individual or their property in an accident. It, however, does not cover any damage to own car that also belongs to the policy holder.

2. Comprehensive Insurance

Such a kind of insurance is more extensive as it includes third party liability and injury to their vehicle too. It covers theft, fire, vandalism and natural hazards, and therefore, it is the best option when one wants to have a complete peace of mind.

3. Collision Coverage

Collision insurance covers the cost of the damage to your car in the occurrence of a crash with a vehicle or an object, despite who was at fault. It is largely of benefit in the newer or high priced automobiles.

4. Personal Injury Protection (PIP)

PIP pays medical costs to both the driver and the passengers in any form of accident in which fault is not a factor. Its covered expenses also include wages that people have lost and rehabilitation expenses in some areas.

5. Uninsured/Underinsured Motorist Coverage

This covers one in case the other party that is involved in an accident does not have insurance or they have no proper cover to meet the cost of damages. It aids in making sure that you do not have to cater with the bill in these cases.

The purpose of each of these types of insurance is different, and the choice will be related to the personal needs, the value of the car and the way, in which it is used on the road.

III. Key Factors to Compare

Coverage Options

Coverage is one of the most crucial foreign items of comparison whenever one is choosing vehicle insurance. Some policies can only cover third party damages whereas others can also include cover on your very own car, theft, fire, natural calamities, or even on any personal injury.

You need to be very keen in what the policy covers and what it does not cover too. Common exclusions entail the damages caused by the illegal behaviors, driving under the influence or wear and tear. Knowledge of these features will keep you out of surprises when you make your claim and align the policy with your demands.

Premium Costs

Insurance premiums that can be paid on a monthly basis or at the end of the year differ depending on a number of factors. The premiums that are calculated by insurance companies are based on your age, gender, history of driving, your vehicle make and model, and where you reside. As an example, people with new cars and especially young drivers are willing to pay more.

The cost is also likely to be escalated in busy cities and busy roads. Make some comparisons with the prices charged by the different providers to get the most economical plan that would not limit you to necessary coverage.

Claim Process

This can make the difference of whether the claim process is very easy or not. A competent insurance company has a straightforward, quick and transparent process of making claims. Make sure that you find companies that offer a 24/7 claims service, on-line filing, and quick approval. There is also an opportunity to read about the experiences and reviews of customers to understand how efficiently the company manages its claims.

Customer Service

Good customer means that you will receive assistance when you need it the most. A good insurance firm has various points of customer services such as phone, email, and chat. Respite, courteous behavior and quick helping in times of need count a lot towards total satisfaction.

Discounts Offered

Most insurance providers provide all types of discounts that can cut your bill considerably. Safe driving where you get a no-claim bonus, discounts that get applied when you insure several cars, or you have safety features on your car are the most common ones. Utilizing them will assist you to reduce your insurance rates and at the same time retain good coverage.

Deductibles

A deductible is what you will have to pay before your coverage comes in. The more you pay in deductible, the cheaper the premium, and thus, the more you will have to pay should you need any coverage. The trick to maintain cost and risk is a good combination of these two, premium and deductible.

Add-ons & Customization

Current-day insurance companies enable you to add-ons to your policy to make it beneficial. Roadside assistance, engine protection, zero depreciation cover, and depressing to cover, are the popular ones. These add-ons make your premium heavier on your pocket a bit but in long run, they are more protective and convenient to you.

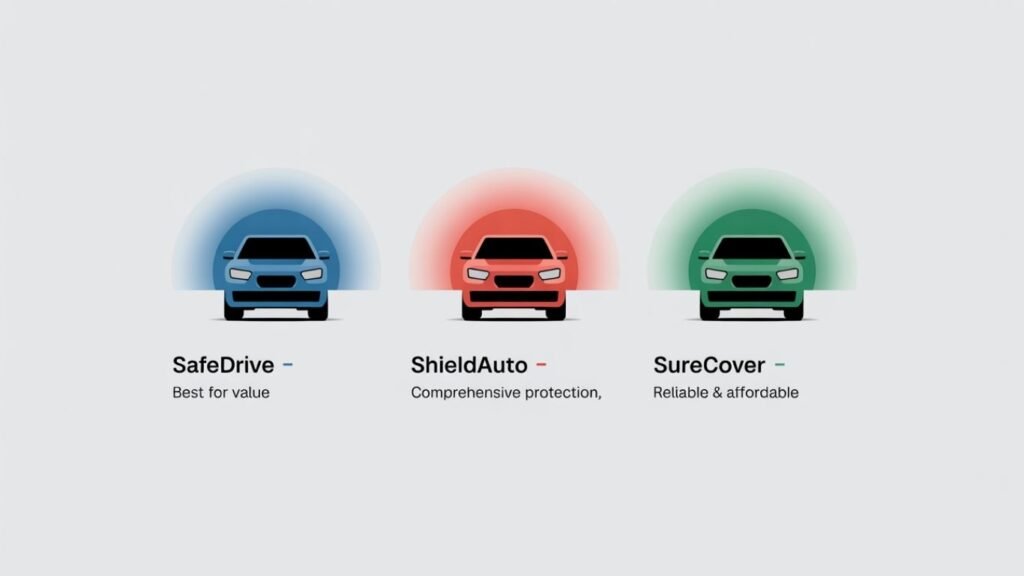

IV. Comparison Between Insurance Providers

Major companies such as State Farm, Geico and Progressive have their own advantages. The State Farm is an excellent customer service provider and has local agents support, and it can be more expensive. Geico has low rates and an easy-to-use application, but it lacks an access to personal agents.

Progressive offers discounts and flexible rates, which particularly are given to high-risk drivers, yet customers may have differences in their service. State Farm is rated high in terms of reliability and the process of handling claims. Geico is acclaimed to be cheap and convenient. Progressive has both positive and negative remarks, which are good in terms of savings but not reliability of service. It all depends on your driving profile, service and your budget.

V. Pros and Cons of Low-Cost vs. Full-Coverage Insurance

Low-cost/basic insurance is cheaper and meets legal minimums, making it ideal for older cars or A cost-benefit analysis reveals that basic insurance will save on money initially but can result in an increase of out-of-pocket cost in case of an accident.

Full coverage is more expensive on a monthly basis yet in more serious incidences it may help in avoiding major losses. When the worth of your car is minimal, select basic, and when you have a serious demand of financial protection, choose full coverage.

VI. Tips for Choosing the Right Insurance

Begin by analyzing your driving behavior and the type of vehicle, like a newer car or lots of long trips in which it may need full coverage but an older car that is seldom driven may only need the basic insurance. Next, compare the total cost along the time, not only monthly premiums. Think about deductibles, limits to coverage and post-claim expenses.

Never make assumptions and read the policy to see what is not covered and what is. Avoid being lured by price only and compare feature, reviews, and discounts as available on the online comparison tools of the various providers. This assists you in getting the most suitable value of your own needs.

VII. Conclusion

Purchasing the ideal car insurance is selecting a superior prospect, getting the low-cost auto cover versus a full cover, and gauging your personal needs on the road. Each of the brands, State Farm, Geico, and Progressive has its own advantages, so choosing your perfect one will depend upon your priorities: saving money or time as well as receiving service and support.

Choosing informed will provide you with the required protection but at a reasonable price. Last piece of advice: At least no need to spend big bucks buying comprehensive insurances in case you have an old model car or a limited budget. However, new cars or when you want peace of mind full coverage is worth its price. It is always good to go around and read policies before making a decision.